South East milestone

Press release

Start Up Loans celebrates £350 million of loans to businesses in Eastern England.

- Since launching in 2012, Start Up Loans has delivered more than 36,700 loans worth over £352 million, to businesses in the East Midlands, East of England, North East, South East and Yorkshire & The Humber, with the average loan being £9,522

- Counties across the South East receiving the most funding since 2012 include Kent and Hampshire

- 12,381 loans drawn down by recipients in Eastern England since 1 April 2020 totalling £154.4 million

- 44% of the total value of loans in South East delivered since the pandemic began

Start Up Loans, part of the British Business Bank, announces that the programme has delivered more than 36,700 loans worth more than £352 million to businesses in Eastern England. The figures point to the spirit of entrepreneurship across the Eastern counties of the country.

The South East has received over 9,900 loans worth over £100 million since 2012. Of these loans, 3,463 amounting to more than £44 million were drawn down in the region since the pandemic began; this equates to 44% of the total value of loans delivered over the lifetime of the programme.

Impressive figures for entrepreneurship during the pandemic show how people have been helped by Start Up Loans to launch their own businesses when conditions in the job market were difficult.

| UK Region | Loans Made | Amount Lent (£) | Average Loan Amount (£) |

|---|---|---|---|

| East Midlands | 5,591 | 51,242,029 | 9,183 |

| East of England | 7,071 | 67,735,762 | 9,576 |

| North East | 5,401 | 49,285,310 | 9,125 |

| South East | 9,926 | 100,827,373 | 10,117 |

| Yorkshire & The Humber | 8,715 | 83,724,688 | 9,607 |

| Total | 36,704 | 352,916,161 | 9,522 |

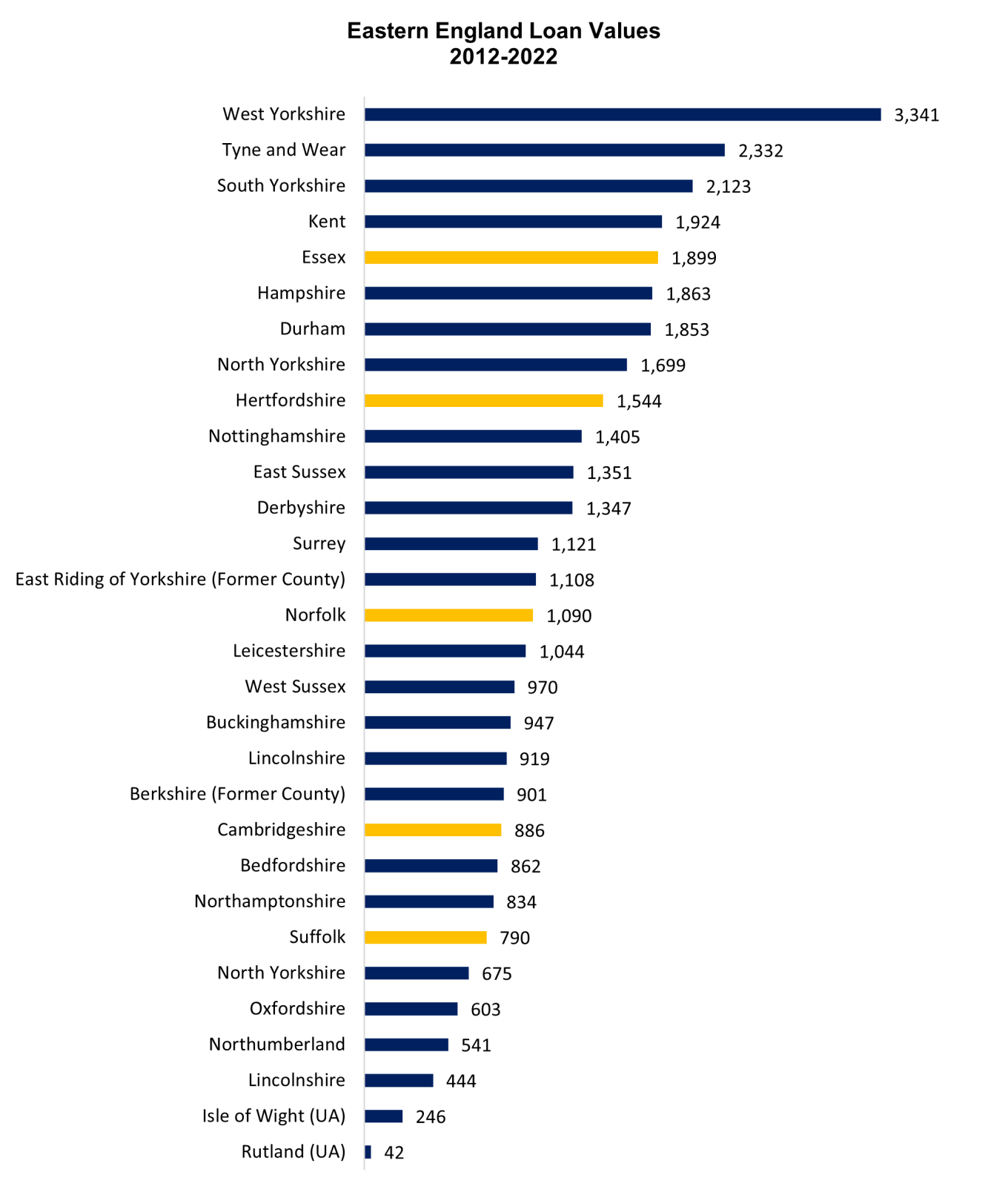

Listed in the below chart are the counties throughout the East to receive the most loans since 2012. Top counties across the South East include Kent, which received more than £17 million in funding, and Hampshire which received over £19 million in funding.

Of the total 36,704 loans in Eastern regions, 40% have been to women and 14% to people from Black, Asian and Other Ethnic Minority backgrounds (not including White Minorities). Young people between 18-24 years old have received 14% of the loans in the East since 2012, and 36% of the total loans made to people in the same age bracket nationally since the programme began in 2012.

If we are to unlock economic growth, we need to remove the barriers faced by the UK’s most innovative entrepreneurs when it comes to accessing funding and growing their business. Backed by more than 9,926 loans worth more than £100 million our most dynamic small businesses across the South East have been able to tap into government support to flourish and fast-track their business ideas and innovations to market. - Kevin Hollinrake Small Business Minister

It’s a testament to the entrepreneurial spirit of the South East that we’re celebrating such a significant milestone, over £350 million pounds, invested across the Eastern regions since 2012. I am particularly proud of the fact that we have been able to support such a huge volume of young aspiring business people and their start up ventures in the East, which represents 30% of the total across the entire of the UK. - Steve Conibear UK Network Director, South and East of England UK Network

The business community in the South East is going from strength to strength. As one of the Ambassadors for Start Up Loans, I am grateful to be in a position to inspire and support other aspiring business owners. Having a strong business network and information that is easily accessible, are vital for making that first step into business ownership. The figures show that more and more entrepreneurs are taking the plunge, which is testament to the business community we have here. I would urge anyone thinking about starting their own venture to go for it in the New Year. - Chloe Bruce Owner Chloe Bruce Academy, Woking, South East

| UK Region | County | Loans Made | Amount Lent (£) | Average Loan Amount (£) |

|---|---|---|---|---|

| Yorkshire and The Humber | West Yorkshire | 3,341 | 32,800,310 | 9,818 |

| North East | Tyne and Wear | 2,332 | 21,466,276 | 9,205 |

| Yorkshire and The Humber | South Yorkshire | 2,123 | 21,005,776 | 9,894 |

| South East | Kent | 1,924 | 17,110,402 | 8,893 |

| East Midlands | Northamptonshire | 834 | 8,627,399 | 10,345 |

| East of England | Essex | 1,899 | 17,885,556 | 9,418 |

| South East | Hampshire | 1,863 | 19,765,717 | 10,610 |

| North East | Durham | 1,853 | 16,674,830 | 8,999 |

| Yorkshire and The Humber | North Yorkshire | 1,699 | 16,392,876 | 9,649 |

| East of England | Hertfordshire | 1,544 | 15,289,634 | 9,903 |

| East Midlands | Nottinghamshire | 1,405 | 13,042,822 | 9,283 |

| South East | East Sussex | 3,341 | 11,406,770 | 8,443 |

| East Midlands | Derbyshire | 1,347 | 11,169,604 | 8,292 |

| South East | Surrey | 1,121 | 12,327,438 | 10,997 |

| Yorkshire and The Humber | East Riding of Yorkshire (Former County) | 1,108 | 9,446,025 | 8,525 |

| East of England | Norfolk | 1,090 | 10,143,773 | 9,306 |

| East Midlands | Leicestershire | 1,044 | 9,974,636 | 9,554 |

| South East | West Sussex | 970 | 9,570,716 | 9,867 |

| South East | Buckinghamshire | 947 | 11,393,731 | 12,031 |

| East Midlands | Lincolnshire | 919 | 8,086,540 | 8,799 |

| South East | Berkshire (Former County) | 901 | 10,431,917 | 11,578 |

| East of England | Bedfordshire | 862 | 88,155,760 | 9,461 |

| East Midlands | Northamptonshire | 834 | 8,627,399 | 10,345 |

| East of England | Suffolk | 790 | 7,382,515 | 9,345 |

| North East | North Yorkshire | 675 | 5,761,588 | 8,5365 |

| East Midlands | Derbyshire | 1,347 | 11,169,604 | 8,292 |

| South East | Oxfordshire | 603 | 7,156,7534 | 11,869 |

| North East | Northumberland | 541 | 5,382,616 | 9,949 |

| Yorkshire and The Humber | Lincolnshire | 444 | 4,079,702 | 9,189 |

| South East | Isle of Wight (UA) | 246 | 1,663,930 | 6,764 |

| East Midlands | Rutland (UA) | 42 | 442,029 | 10,525 |

| Total | 36,704 | 352,916,161 | 9,615 |

Notes to editors

About Start Up Loans

The Start Up Loans programme provides personal loans for business purposes of up to £25,000 at a 6% fixed interest rate per annum and offers free dedicated mentoring and support to each business.

The primary aim of the Start Up Loans programme is to ensure that viable start-ups and early-stage businesses have access to the finance and support they need in order to thrive. A network of Delivery Partner organisations supports applicants in all regions and industries throughout the UK. The Start Up Loans programme is not designed to generate a commercial profit. Capital payments together with the interest are recycled to help meet our customers’ increasing demands for finance.

Free guides on a range of subjects related to starting a business and recent media press releases are available on the Start Up Loans website.

The funding for the Start Up Loans programme is provided by the Department for Business, Energy and Industrial Strategy (BEIS). A development bank wholly government-owned by BEIS, the British Business Bank plc is not authorised or regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA). The British Business Bank and its subsidiary entities are not banking institutions and do not operate as such.

The British Business Bank makes finance markets for smaller businesses work better, helping the sector to prosper, to grow and to build economic activity.

Key Statistics

- Since its inception in 2012, the Start Up Loans scheme has delivered almost 99,800 loans, providing more than £934 million of funding.

- In the financial year 2021/22, the scheme provided 12,433 loans with a total value of approximately £152.4 million.

- The economic benefits of the Start Up Loans programme are almost six (5.7) times its economic costs.

- At Spending Review 2021, the Chancellor announced resources to provide 33,000 Start Up Loans over next three years.

Aside from the return-on-investment numbers these statistics are gross estimates and based on Start Up Loans CRM along with externally commissioned research undertaken by SQW Ltd, with support from BMG Research. Since 2012, 5% of loans went to people formerly unemployed or economically inactive. Some 40% of loan recipients were women and 21% were from Black, Asian and Other Ethnic Minority backgrounds (not including White Minorities).

Quick links

Latest news

-

Read more about £4m delivered to ex-military entrepreneurs via Start Up Loans and X-Forces Enterprise over last year Press release

25 June 2025 -

Read more about Lancashire businesses supported with £25m of Start Up Loans support Press release

10 June 2025 -

Read more about Start Up Loans passes £100m funding milestone in the West Midlands Press release

10 June 2025